India $10.45 Billion Ethanol Market Competition Forecast & Opportunities, 2029F – Supportive Government Policies and Increasing Demand for Biofuels for Sustainable Development

DUBLIN, Jan. 11, 2024 /PRNewswire/ — The “India Ethanol Market Competition Forecast & Opportunities, 2029” report has been added to ResearchAndMarkets.com’s offering.

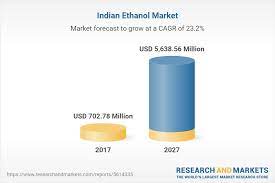

The India Ethanol Market attained a valuation of USD 6,512.27 Million in 2023 and is poised for robust growth in the forecast period, projected to achieve a Compound Annual Growth Rate (CAGR) of 8.84% through 2029 and is anticipated to reach at USD 10456.98 million by 2029.

Ethanol, a renewable fuel derived from various plant materials collectively referred to as ‘biomass,’ is driving this growth. Ethanol’s lower carbon intensity compared to conventional fuels has resulted in reduced carbon emissions, aligning with India’s climate goals. The Indian government’s determined push for ethanol blending in petrol has been a transformative factor.

The Ethanol Blended Petrol (EBP) program, initiated in 2003, mandates blending ethanol with petrol to decrease greenhouse gas emissions and promote cleaner fuels. The government’s commitment to achieve 20% ethanol blending in petrol by 2025 has significantly boosted ethanol production. Furthermore, government support in terms of incentives, subsidies, and grants has incentivized investment in ethanol production infrastructure. These incentives have attracted both public and private sector interest, driving increased capacity and output.

Additionally, ethanol production provides an extra revenue source for farmers, contributing to rural economic growth. The promotion of ethanol bridges agriculture and energy sectors, benefiting farmers while bolstering energy security. These factors collectively contribute to the expansion of the India Ethanol Market in the forecast period.

Key Market Drivers

Increasing Demand for Biofuels for Sustainable Development

In recent years, there has been a growing global awareness of the necessity to transition towards sustainable energy sources due to concerns regarding climate change, depleting fossil fuel reserves, and the urgency to mitigate environmental degradation. India has emerged as a leader in adopting alternative energy solutions, with a strong emphasis on biofuels as a vital component of its sustainable development strategy. Ethanol, among the biofuels, has gained prominence as a cleaner and greener substitute for traditional fossil fuels.

The escalating demand for biofuels, specifically ethanol, aligns with India’s pursuit of sustainable development, representing a fundamental shift in the country’s energy landscape. Additionally, India’s growing population, rapid industrialization, and urbanization have led to a significant rise in energy consumption. To meet this demand, India heavily relies on imported fossil fuels, leaving it exposed to global price fluctuations and geopolitical uncertainties.

Supportive Government Policies

In light of global calls for sustainable and environmentally friendly energy practices, the Indian government has implemented significant measures to promote the production and usage of ethanol as an alternative fuel. With a strategic focus on reducing carbon emissions, minimizing dependence on fossil fuels, and ensuring energy security, India has introduced a series of favorable policies.

Moreover, the government has actively promoted the production and utilization of Flexible Fuel Vehicles capable of running on various ethanol and petrol blends. This not only increases ethanol demand but also offers consumers greater fuel options. Additionally, government subsidies and incentives provided to sugarcane producers have contributed to the growth of the ethanol market. The combined impact of these government initiatives is expected to drive demand for ethanol during the forecast period.

Increasing Automotive Sector Demand

The automotive sector, a major contributor to carbon emissions, is undergoing a significant transformation as global efforts intensify to combat climate change and reduce environmental impact. This shift has propelled the demand for cleaner and more sustainable fuel alternatives, with ethanol emerging as a frontrunner in reshaping the automotive industry.

The Indian government has also introduced initiatives and policies to promote ethanol use in the automotive industry, further propelling ethanol demand. For instance, the introduction of fuel blended with 20% ethanol (E20) in phases from April 2023 onwards aims to ensure E20 availability by 2025. Ethanol is commonly used as a fuel additive to improve fuel efficiency, reduce emissions, and enhance engine performance. These factors collectively underscore the increasing demand from the automotive sector, thereby driving the India Ethanol Market’s growth during the forecast period.

Key Market Challenges

Limited Awareness

A lack of awareness and understanding about ethanol among consumers and industries could impede its adoption as a fuel source. This lack of knowledge may slow down the transition from traditional fossil fuels to more sustainable alternatives like ethanol. Additionally, misconceptions about the environmental benefits of ethanol-blended gasoline and unfounded concerns about its impact on vehicle engines may negatively influence the sales of blended petrol.

Feedstock Availability Constraints

Fluctuations in agricultural production, weather conditions, and seasonal variations can impact the availability and pricing of feedstocks like broken rice and maize. Moreover, the significant water requirements of the sugarcane industry can contribute to feedstock availability challenges. These factors may hinder the consistent supply of feedstocks, potentially affecting the market’s growth trajectory.

Key Market Trends

Capacity Expansion

India has been actively expanding its ethanol production capacity in recent years. Most of the country’s ethanol is currently derived from sugarcane molasses and cassava, which are locally cultivated crops. Investments in new ethanol plants, both from domestic and foreign investors, have been pouring in, highlighting the market’s potential.

By December 2023, the ethanol production capacity for blending and other uses is expected to reach 12,440 million liters. The launch of major new ethanol projects in line with a new interest subvention scheme, approved by the Food Ministry in January 2023, is anticipated to add around 470 million liters of ethanol. Notably, these projects include grain-based and dual feedstock-based facilities.

Shift Towards Green Fuels

The focus on green fuels, including ethanol, has significantly influenced the India Ethanol Market. The emphasis on green fuels has generated higher demand for ethanol as a renewable fuel source. Ethanol is viewed as a cleaner and more sustainable alternative to fossil fuels, with government policies and incentives driving the adoption of biofuels in transportation.

This shift towards green fuels has also led to the diversification of feedstocks utilized in ethanol production. In addition to traditional sources like sugarcane and grains, the industry is exploring non-food feedstocks such as algal biomass for ethanol production. The adoption of green fuels offers environmental advantages, including reduced greenhouse gas emissions and air pollution.

Segmental Insights

Type Analysis:

- The bioethanol segment is expected to experience the highest growth rate of 15.84% from 2025 to 2029.

- Bioethanol is derived from cellulose-rich plants like sugarcane, sugar beet, and grains like corn.

- Bioethanol offers environmental benefits by reducing CO2 emissions, minimizing waste generation, and decreasing dependence on crude oil.

- These advantages drive the growth of the India Ethanol Market during the forecast period.

Application Analysis:

- The fuel & fuel additives category is anticipated to exhibit the highest growth rate of 16.66% from 2025 to 2029.

- This growth is attributed to the widespread use of ethanol-based fuel and additives across various applications, including fuel tanks, fuselage components, wings, and engine parts.

- Ethanol-based fuel and additives offer resistance to temperature, pressure, chemical exposure, strong bonding strength, and durability.

- They present a cleaner and more sustainable fuel option, gaining popularity among consumers and governments, contributing to the India Ethanol Market’s growth.

Regional Analysis:

- The North Region is expected to witness the fastest growth rate of 16.65% from 2025 to 2029.

- This region has a high ethanol production capacity compared to others.

- The forecast period will likely see the opening of more production plants, further increasing ethanol production capacity.

- Abundant feedstock availability in states like Uttar Pradesh, Haryana, and Punjab encourages the installation of ethanol production plants in the North Region.

- These factors collectively contribute to the expansion of the India Ethanol Market in the North Region.

Key Market Players

- India Glycol Limited

- Triveni Engineering & Industries Ltd.

- Shree Renuka Sugars Limited

- Balrampur Chini Mills Limited

- Dhampur Sugar Mills Ltd

- Bajaj Hindusthan Sugar Ltd.

- Dalmia Bharat Sugar and Industries Limited

- E.I.D.-Parry (India) Limited

- Simbhaoli Sugars Ltd.

- Mawana Sugars Limited

Report Scope:

Ethanol Market, By Type:

- Bio Ethanol

- Synthetic Ethanol

Ethanol Market, By Purity

- Denatured

- Undenatured

Ethanol Market, By Raw Material:

- Sugar & Molasses Based

- Grain Based

- Lignocellulosic Biomass

- Algal Biomass

Ethanol Market, By Application:

- Fuel & Fuel Additives

- Industrial Solvents

- Disinfectant

- Personal Care

- Beverage

Ethanol Market, By Region:

- North

- West

- South

- East

For more information about this report visit https://www.researchandmarkets.com/r/qwct00

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Recent Comments