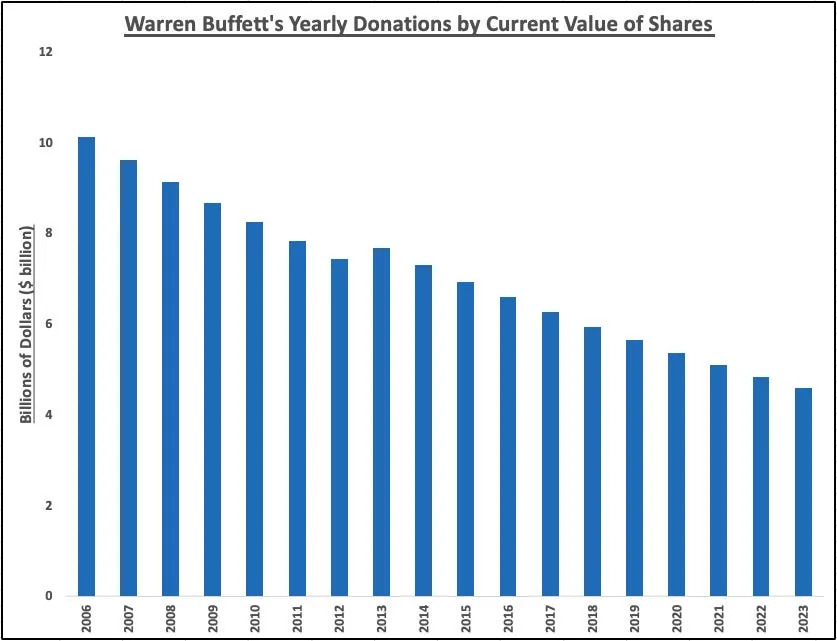

Warren Buffett has given Berkshire Hathaway stock worth $130 billion today to philanthropic groups. Here’s a chart showing his donations since 2006.

Theron Mohamed Yahoo News

- Warren Buffett gifted $4.6 billion of Berkshire Hathaway stock to philanthropic groups this week.

- He’s given $50 billion of shares based on their value when received, or $130 billion worth at current prices.

- Scroll down for a chart showing Buffett’s annual donations since he began making them in 2006.

Warren Buffett gifted a total of $4.6 billion of Berkshire Hathaway stock to five philanthropic groups this week. Here’s a chart showing the value of his donations over the past 17 years based on Berkshire’s stock price today:

The famed investor and Berkshire CEO pledged in 2006 to donate about 85% of his nearly 475,000 Berkshire Class A shares to the Bill & Melinda Gates Foundation, a foundation named for his late wife, and a trio of foundations run by his three children.

He decided to gift 5% of the earmarked shares in 2006, then 5% of the remaining shares in 2007, and so on. That structure explains why his contributions have shrunk each year, expect for 2013 when he doubled the size of his donations to his children’s foundations.

To date, Buffett has converted about 275,000 of his “A” shares into much cheaper and more liquid “B” shares, then contributed those to the five groups as planned. The shares he’s given away are worth about $50 billion based on their value when received, or more than Buffett’s personal net worth in 2006. All else being equal, they would be worth about $130 billion today based on Berkshire’s stock price, which has surged by more than five-fold since the giving program began.

In other words, if Buffett had retained all of the shares instead of gifting them, he would likely be the world’s richest person with a net worth of about $250 billion — comfortably ahead of Elon Musk’s $236 billion fortune, per the Bloomberg Billionaires Index. Even after his donations, Buffett is ranked seventh in the index with a $113 billion net worth.

The Berkshire boss reached the halfway point in his gifting two summers ago, and has now jettisoned about 54% of his shares. The Gates Foundation, which focuses on combating poverty, disease, and inequity worldwide, counts Buffett as its largest financial contributor.

“Warren’s generosity plays an enormous role in achieving the foundation’s ambitious goals and has made an impact on millions of lives,” Bill Gates tweeted on Thursday.

Recent Comments